The train is leaving the station.

- The Coachmen

- Jun 14, 2022

- 3 min read

Well folks, happy FOMC day! Markets were largely sold off on Monday and only started to recover yesterday and today as participants became more and more acclimated to the probability of a 75bp rate hike today. That said, there is still a 5% chance of a surprise 100bp interest rate hike, which would likely plunge markets further - keep that in mind as we provide you with further inspiration to weather the storm!

“It is the rare fortune of these days that one may think what one likes and say what one thinks.”

- Tacitus

Market Talk

In what is hopefully the last leg of the crypto winter, Bitcoin’s usual weekend sell-off was further exacerbated by the broader market’s losses on Monday; this brought the price of Bitcoin down to $22K USD, a level unseen since the end of 2020. We still have a high level of conviction in our Bitcoin thesis and would like to point out that its price is rejecting an extended stay below the key 200-week MA. Throughout the entirety of Bitcoin’s lifespan, the 200-week MA has never failed at supporting its long-term appreciation, now is the time to buy.

Long: The Kroger Co. (KR:NYSE) | Timeline: 4-7 days

The Kroger Co. (KR) operates a combination of food and drug stores, multi-department stores, marketplace stores, and price impact warehouses throughout the United States. Helped by steady store traffic and growing demand for cheaper household products, Kroger is still expected to report a 3.4% rise in first-quarter earnings through one of the highest inflation periods in history. Although Kroger is not fully immune to market pressure, corporations like Walmart or Target will suffer much more from discounted rates as Kroger’s business model has always been consumables driven, giving them the edge through the Q1 earnings season. Taking a look at the chart, KR traders tend to react quickly with last quarter's earnings beat shot the stock up about 40% in just two weeks. Since then, there has been a slow cool off but as investors begin to show positive sentiment towards this quarter's earnings, the MACD has reversed itself and an ascending triangle has formed - a widely used triangle pattern that can be used to signal a trend reversal.

Long: Microsoft Corporation (MSFT:NASDAQ) | Timeline: 1-2 days

To put it bluntly, the market is walking on extremely thin ice at the moment, with stock prices fluctuating wildly day by day. Not much has changed in the greater scheme of things, however, from current signals on the street we are likely to experience a short-lived bear market rally. Out of the portfolio of large, recently battered tech companies, we chose to side with Microsoft as they are likely to see measured moves to the upside, with the chance of mild downside risk being far less than other tech firms.

Let me explain. Microsoft is a longstanding firm with a diverse, multifaceted product line, offering physical and digital goods. This means they’ll be somewhat hedged even if negative shipping news comes into play, being less affected compared to other firms. Most importantly, Microsoft is our hedge for today as they have the most important things in this current market, low debt and profitability status. Microsoft is an absolute behemoth whose various offerings power businesses across the world, and as a result, they aren't going anywhere for a long time.

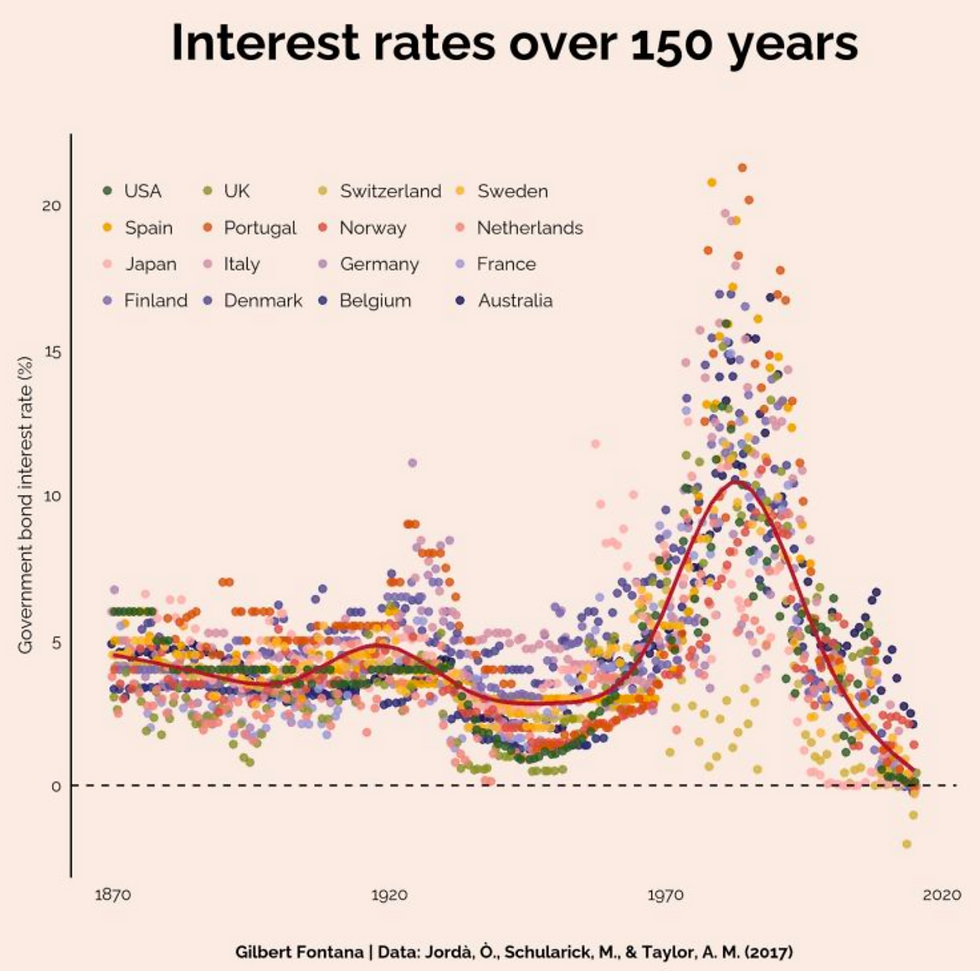

Chart of the Day - Interest Rates in the Modern Era

Comments