The Q2 Crucible

- The Coachmen

- Jul 5, 2022

- 3 min read

Morning folks, we hope you all had a fantastic holiday weekend - That being said, welcome to the 13th week of the Coachman's Report! Today, we’ve got an update on global markets, some trade ideas, and a short piece on the potential halt of Russian exports that could bring oil to new highs (and has some investment banks forecasting $200+ oil prices).

“Never say never, because limits, like fears, are often just an illusion”

- Michael Jordan

Market Talk

After climbing modestly during Friday’s trading session, the S&P, NASDAQ & Dow were up 1.06%, 0.9% and 1.05% respectively. the NASDAQ climbing 0.9% - the major indices are set for a measured decline today, as index futures are down between 0.5% and 0.75% heading into Tuesday’s trading session.

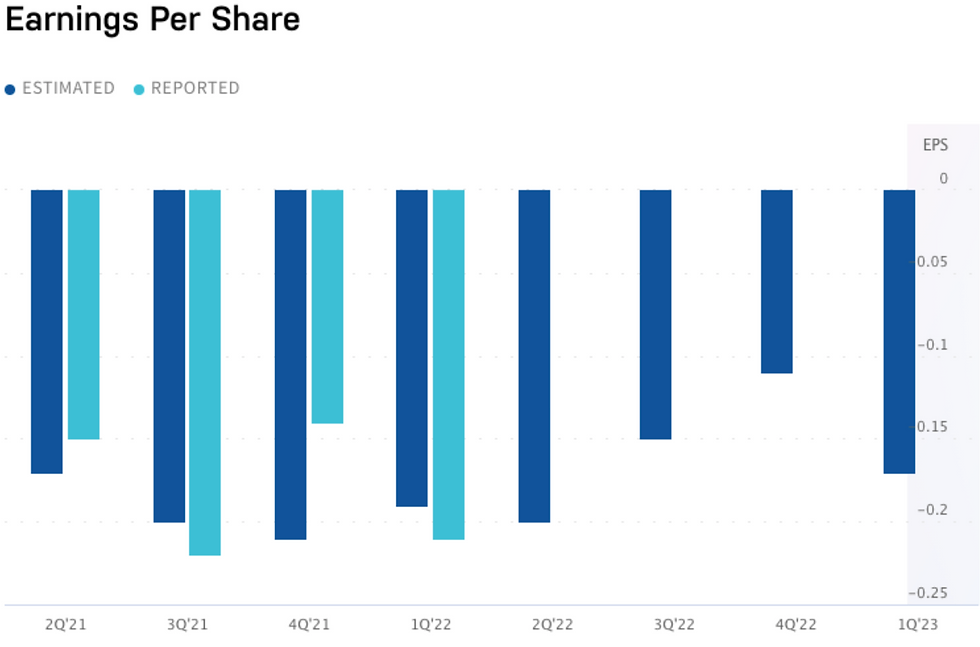

That said, the next stumbling block for markets that could extend this sell-off is Q2 earnings - despite many material shifts in the economy over the last quarter, including a much more aggressive interest rate agenda than we’ve seen before, continually affected supply chains, and another jump in energy prices, it is unlikely that markets live up to the below expectations. Moreover, while bearish investor sentiment has hovered around all-time-highs for the year this last couple of weeks, consensus estimates have barely been revised over the same time period.

Long: Simulations Plus, Inc ($SLP-NASDAQ) | Timeline: 2-3 days

Simulations Plus, Inc. develops drug discovery and development software for modelling and simulation and predicts molecular properties utilizing AI and machine learning-based technology worldwide. Just a couple of weeks ago, Simulations Plus announced a collaboration with a multinational pharmaceutical company in order to provide support for Covid-19 treatment, which is excellent news for investors as we approach the company’s earnings release on Wednesday.

Taking a look at the chart, Simulations Plus has reversed and bulls have successfully taken charge, signalled by the MACD blasting through 0 and the price breaking through its 200-day MA. A key pattern to keep in mine is an ascending triangle - a widely used chart pattern where

traders tend to aggressively buy the asset as the price breaks out.

Long: Monster Beverage Corporation ($MNST-NASDAQ) | Timeline: 1-2 days

Special Bulletin: Oil Could Skyrocket at a Moment’s Notice

As the conflict in Ukraine has now gone on for over four months, Western nations have begun throwing everything but the kitchen sink in sanctionary terms. While originally somewhat effective, it seems as if the Russians are better off in the long term, as the Ruble has appreciated significantly compared to the USD since the second month of the conflict. Rising against the greenback to levels not seen since early 2017. Aside from the broad majority of sanctions not having their intended effect, the oil sanctions are an example of a well-intentioned, poorly thought out effort that could come back to bite the West, as JP Morgan is reporting that in retaliation to the G7’s proposed price caps on Russian oil, Russia could slash production.

With reports that the nation could cut crude production by 5 million barrels without seriously damaging their economy, this same cut would bring London crude prices to $380. Even in a scenario where only 3 million barrels per day are cut, this would still send prices up to $190. This report is compounded by the tense relationship between the Saudis and the Biden administration as they’ve offered little to no help to relieve pressure on global oil markets. From now on, it’s a waiting game, as the Russians look to use every non-kinetic weapon in their arsenal to win the war abroad.

Chart of the Day

Estimated share of S&P 500 revenue generated in the U.S versus abroad through the last 12 months.

Comments