The Coachman's Report - Unstable

- The Coachmen

- May 12, 2022

- 3 min read

Well folks, inflation was slightly above expectations yesterday with the Consumer Price Index increasing 0.3% for the month of April - the good news is that we are likely beyond peak inflation, with this print bringing the TTM rate down to 8.3% from 8.5%. Interestingly enough, crypto markets sharply corrected when this was reported - lending credence to their role as an inflationary hedge. Keep reading for some more trades within this volatile market!

“Natural ability without education has more often raised a man to glory and virtue than education without natural ability.”

- Marcus Aurelius

Market Talk

The crypto market has recently experienced something that had never been seen before - Terra (Luna), a popular cryptocurrency has dropped over 97% from highs within the last week, this erasure in value has also erased over $26.5Bn of value, bringing the coin’s market cap down to roughly $600M. Pictured below - Tera’s popular stablecoin, meaning a cryptocurrency allegedly pegged to the value of the US dollar, but recently crashed to a value of $0.35, yet has since recovered to a value of $0.65.

In other crypto news, a recent Coinbase filing has both investors, and users of the platform spooked. Hidden deep within the company’s latest earnings report it states that due to the nature of crypto assets being held in custody by Coinbase, they can be involved in bankruptcy proceedings, while customers would be treated as unsecured creditors. Meaning that if the company files for bankruptcy your digital assets could be seized, while you would not be compensated. You can read more about it here, the warning in question is on page 84, and remember, your coins aren’t your coins unless held in a self custody wallet.

Today's report is brought to you by...

As you know, we offer these actionable trade ideas to you, the reader, for no cost. That being said, we’ve begun to partner with brands that can offer you the best in class option for your financial journey.

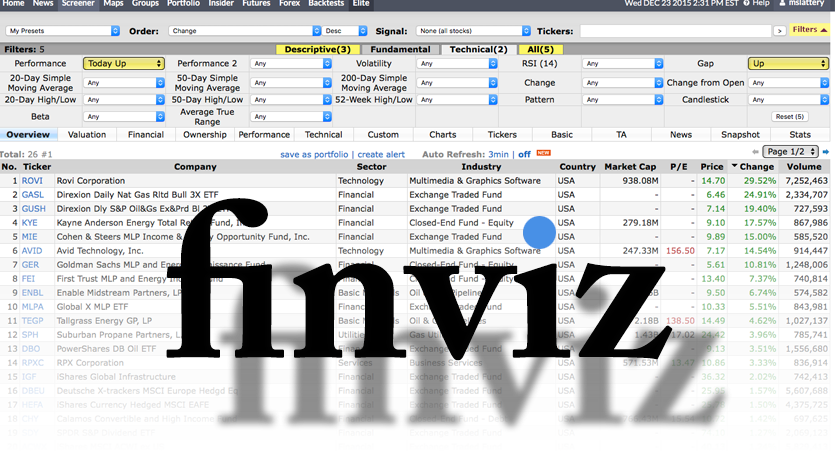

The first of which is FinViz, a stock screening website that allows you to gain actionable technical and fundamental insights for your potential investments, while also offering a myriad of other features. By signing up for FinViz Elite, you can gain access to a multitude of services like real-time market updates, interactable charts and an inside trade tracker, just to name a few. If you’re in the market for a powerful financial tool to assist in your trading and want to support the Coachmen while you’re at it, sign up for FinViz Elite using this link!

Short: Carvana ($CVNA-NYSE) | Timeline: 1-3 Days

Carvana is an online car dealership and vehicle financing platform that allows customers to complete all manner of transactions from buying, selling, financing and more. The company’s business model is unsustainable for the time being, as they began paying outrageous prices for used vehicles during the height of the chip shortage. However, now that there is a lull in the market the company is stuck with expensive, and constantly depreciating inventory. The majority of cars that they sell will be at an immense loss, and as a result, the short-term future of this company is going to be tumultuous, to put it mildly. This is also signalled by an announcement made yesterday, as the company was reported to have laid off 2500 employees, or 12% of the company’s total workforce (source). However, in this instance, I will give credit to the company’s executive team, as in the same announcement they pledged to forgo salaries for 2022.

Management’s morals, and long-term predictions aside, this company is being given a short for the time being. In terms of the technicals, the stock experienced a death cross in December 2021 and has been suffering immensely ever since. Additionally, both the MACD and momentum are flashing extremely bearish signals.

Long: CyberARK Software Ltd. (CYBR:NASDAQ) | Timeline: 2-4 days

CyberARK Software Ltd. (CYBR), who engages in the development, market, and sale of access security software solutions, is set to report successful earnings today after the bell. Nine analysts have provided estimates for CYBR’s earnings, with $129.04 million being the lowest estimate and $138.00 million being the highest, suggesting a positive year over year growth rate of 16.3% from Q1 2022, presenting a great long opportunity over the next few days as investor sentiment is bound to spike.

After bears pushed the share price under the 100-day MA, CYBR has failed to regain its footing as investors are unsure where a line of support may occur. However, as analysts provide investors with positive sentiment toward earnings, this stock is bound for a comeback into bullish territory.

Chart of the Day: Growth of the Russell 2000 vs. The Value Index (EV to TTM Sales Diff.)

Comments