The Coachman's Report - "This too shall pass"

- The Coachmen

- May 10, 2022

- 4 min read

Well folks, what can we say, even as indices, cryptocurrencies, and most individual equities were battered down into the single and double digits, the Coachmen were once again in the money. If you didn’t manage to catch yesterday's trade ideas, you missed out on double-digit returns on the VIX, and Peloton. However, you don’t have to feel left out for too long, as we’re back at it again with more actionable ideas to supplement your trading theses.

“The happiness of your life depends upon the quality of your thoughts”

- Marcus Aurelius

Market Talk

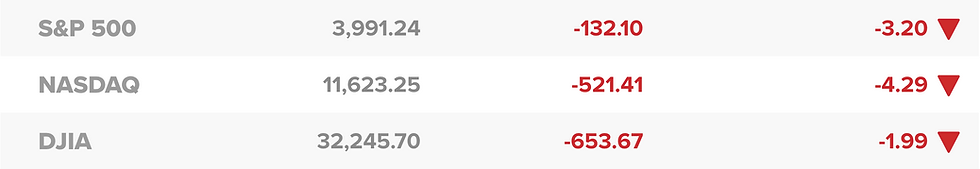

Let’s be honest, the markets have seen far better days, with every index sliding it’s hard to know where to put money as it seems as if everything is going down. The Dow Jones dropped by 1.99%, the S&P slid by 3.2%, and the Nasdaq declined by a staggering 4.29%. Even the usual safe havens, gold and oil, were each down by over 1%. Markets are also weary in advance of the inflation data being released tomorrow at 8:30 AM.

On the geopolitics side of things, an interesting development occurred in global relations. As you know during Monday’s trading session no sector was spared from the carnage, a reversal from previous trends of energy stocks decoupling from the rest of the declining indexes, with oil also declining modestly. This drop in oil prices and oil producer valuations could be related to the news from Aramco stating they are implementing a reduction in prices to Asian, and European customers due to the drop in demand caused by the Shanghai lockdowns. Even as prices remain unchanged for US consumers, signaling that the rift between the Biden administration and the Saudi Royal Family continues to widen. While yes the Coachman’s team will be affected by these unchanged prices, honestly who can blame MBS for these increases?

During Joe Biden’s campaign, he was not willing to mince words about his thoughts on how the United States should deal with Saudi Arabia, saying he intended on making the Saudis “pay the price, and make them in fact the pariah that they are”. While also voicing his thoughts on the royal family by saying there is “very little socially redeeming value in the present government of Saudi Arabia” (Source: NYT). Now I’m just as surprised as you are, not necessarily at the hubris of his comments, but because he was able to string together a coherent sentence. And look, whatever opinions you have on the murder of Jamal Khosoggi aside, such rhetoric is not the way that a sitting president should discuss a nation that not only provides an essential commodity but also ensures the global hegemony of the petrodollar remains in place. This move could prove disastrous for not only the United States, but also Canada, as this flow of cheaper oil into the world market could make the Canadian energy sector less attractive to foreign buyers.

Today's report is brought to you by...

As you know, we offer these actionable trade ideas to you, the reader, for no cost. That being said, we’ve begun to partner with brands that can offer you the best in class option for your financial journey. The first of which is FinViz, a stock screening website that allows you to gain actionable technical and fundamental insights for your potential investments, while also offering a myriad of other features. By signing up for FinViz Elite, you can gain access to a multitude of services like real-time market updates, interactable charts and an inside trade tracker, just to name a few. If you’re in the market for a powerful financial tool to assist in your trading and want to support the Coachmen while you’re at it, sign up for FinViz Elite using this link!

Long: Fiverr International Ltd (FVRR:NYSE) | Timeline: 2-3 days

With one of the strongest job markets in recent history and unemployment at a rate of 3.6% - this ‘great resignation’ wasn’t only the result of a pandemic wakeup with a workforce that felt fed up with their employers, but one that realized that the gig-economy had matured as an industry and that freelance work could be a legitimate full-time income source; additionally, the amount of people that started working two jobs or supplementing their income throughout the pandemic has grown exponentially faster than ever before. This will likely continue into the future with the last quarter of Friday jobs reports (since Fiverr’s last quarterly earnings) adding strong numbers to the professional services-based industries.

This crowd-sourced freelancer marketplace is poised for a hit on earnings as it has beat EPS estimates for the last 8 consecutive quarterly reports, during which time it has been unfairly battered down 87% from highs and is now at a level where both its RSI and Price to Book ratio historically bounce back up to fair value from. Despite the 50-day MA trending far below the 200 for almost three quarters now, the spread between the two is starting to narrow as this name is ripe for a turnaround with earnings slated to be reported tomorrow and an EPS estimate of just $0.04 needed to be beat for an earnings surprise.

Short: Coinbase Global, Inc (COIN:NASDAQ) | Timeline: 2-3 days

The reality of tighter monetary policy continues to be felt in all markets, including crypto, as Bitcoin and Ethereum drop to lows that haven’t been seen since July of 2021. Coinbase Global, Inc (COIN), which provides financial infrastructure and technology for the crypto economy, will continue to face these headwinds as the company is expected to report an unforgiving first-quarter earnings report today.

For COIN, price action has been the biggest giveaway as bears continue to have bulls in a chokehold, with the price of the stock having considerable instability after falling under the key psychological share price of $100. Aside from this, a ton of short volume along with the RSI and MACD indicating more downwards momentum speaks for itself when talking about investor sentiment towards this quarter’s earnings report, making for a great short opportunity through the next few days.

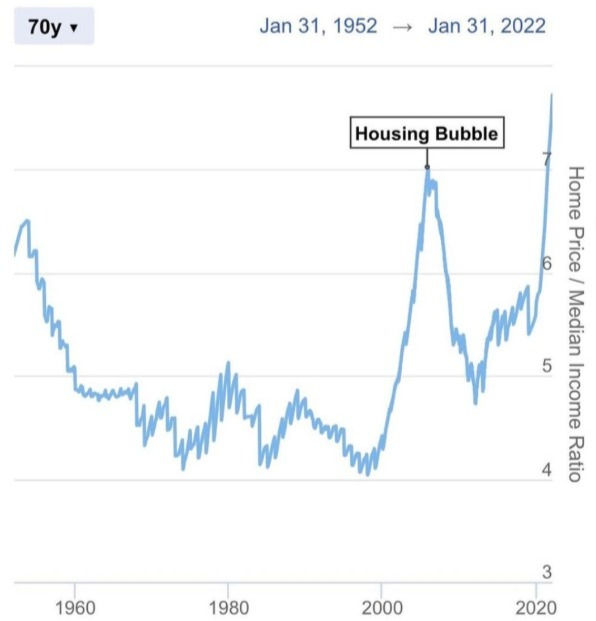

Chart of the Day: Median Home Prices to Income Ratio - We’ve now surpassed the housing bubble!

Comments