The Coachman's Report - A decisive week ahead.

- The Coachmen

- May 9, 2022

- 4 min read

Welcome to the suck, folks - as we head into the 5th week of the Coachman’s Report, markets are at a decisive crossroads; will the sell-off continue? Or will we be saved by a US inflation announcement on Wednesday that breathes new hope into the economy? Regardless, markets will remain choppy as the Q1 earnings season comes to a conclusion so let’s make some trades around it while we can. Also, don’t forget our long-term investment recommendation of Canadian Tire Corporation ($CTC.A) from Friday last week!

"A man who has no imagination has no wings."

- Muhammad Ali

Market Talk

While we don’t usually do a market update on Mondays as exchanges are closed over the weekend, we’d like to take some time to talk about the S&P 500’s current valuation and how this Q1 reporting period has affected it. First, just before this reporting period, the S&P 500’s 200-day moving average crossed below its 50-day, this phenomenon is known as the death cross as it marks a sustained downward trend for a security’s price.

In addition, while the market has also dropped just below 16% from its highs, this earnings season has brought an average EPS growth of just 9.1% to the broader S&P 500 - the lowest rate since 2020’s Q4 rate of 3.8%, however, a silver lining could be the fact that this marks the 5th consecutive quarter of 10%+ revenue growth. This is broken down by sector in the chart below with the S&P 500 experiencing 13.3% top-line growth this quarter.

That said, it’s important to wait and see what this Wednesday’s CPI announcement has in store so we can adjust this 13.3% nominal figure into real terms. Last, I’d like to draw your attention to the market’s current P/E multiple, which has shrunk to 20.84. While earnings growth reported in Q1 obviously had an effect on bringing this down from last month’s more frothy 23.16 number, more can be attributed to the negative return of the index since then (-9% since April 1st) - regardless, it’s worth noting that on a forward basis, the S&P 500 has a price to earnings multiple of 19.44, which is right in line with its historical average. Since July of 2022, when the market’s P/E hit a high within the low 30s, it has trended downwards to current levels; now that it has already reverted to the mean, will it continue? Will it be a result of earnings growth or a gradual decline in equity prices? Let us know your thoughts - if you reply to this email, we’ll do our best to get back to you within one business day.

Today's report is brought to you by...

As you know, we offer these actionable trade ideas to you, the reader, for no cost. That being said, we’ve begun to partner with brands that can offer you the best in class option for your financial journey.

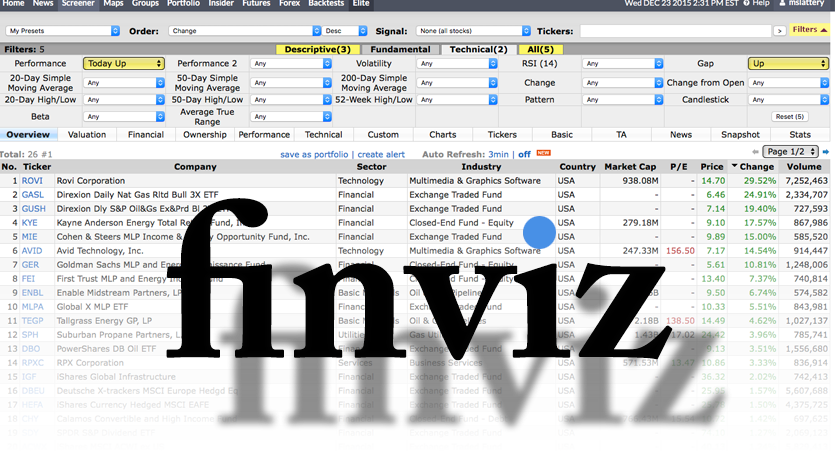

The first of which is FinViz, a stock screening website that allows you to gain actionable technical and fundamental insights for your potential investments, while also offering a myriad of other features. By signing up for FinViz Elite, you can gain access to a multitude of services like real-time market updates, interactable charts and an inside trade tracker, just to name a few. If you’re in the market for a powerful financial tool to assist in your trading and want to support the Coachmen while you’re at it, sign up for FinViz Elite using this link!

Short: Peloton Interactive, Inc (PTON:NASDAQ) | Timeline: 5-7 days

Peleton Interactive, Inc (PTON) is scheduled to announce earnings in today's pre-market trading session, and it's not looking too hot for them. Peloton's products had thrived through the early and middle stages of the pandemic when gyms were closed, and demand for at-home exercise equipment skyrocketed. However, the company has been struggling to regain its footing as economies begin to reopen and consumer preferences shift, while inflation and supply chain issues continue to put even more pressure on the company's bottom line.

Taking a look at technicals, bears have taken the reigns over the last 9-10 months as the past three earnings reports have resulted in the stock nose-diving between 20% and 40% within two weeks of the company's announcement. From Peleton's Q4 2021 report to now, both indicators have cooled off and traders have formed a flag - a trading pattern that gives consolidation at a given price range and signals the likely continuation of the previous trend. As the price approaches that lower end of the flag, a poor earnings report is the catalyst PTON bears will need to break out into the next lowest price channel.

Long: Volatility S&P 500 Index (VIX) | Timeline: 1-2 days

Back again with a familiar, yet profitable trade idea to guide you towards returns in a market filled with woes. The VIX is a fantastic safe haven in times such as these due to its ability to profit from the turmoil currently being experienced across the vast majority of sectors. As mentioned above, the S&P 500 has recently experienced the death cross of moving averages, signalling that a further decline is likely to come.

Outside of technicals, we’re also dealing with reduced investor sentiment due to the large declines seen in equities once considered to be blue-chip. If you’re of the belief that the S&P should return to pre-pandemic levels given the coming reduction of stimulus offered by the Federal Reserve, the index has another 22% to fall. It should also be noted that in early 2020 the world was not experiencing any of the crises that we are seeing today. Many are dubbing the current macroeconomic conditions as the “unholy trinity”, as we are seeing rising rates, oil prices, and the strengthening of the US dollar. While a rising dollar may seem beneficial, in actuality it is the worst-case scenario for American exporters, as when the dollar rises in value, international customers will begin to be priced out of goods. Which will lead to a reduced quantity of goods ordered, or force the exporters to slash prices, unlikely given the rising cost of inputs and labour. Furthermore, S&P futures have declined by over 1.2%, signalling a red open to start Monday’s trading session. Even as the VIX has experienced a series of rapid price movements within the past weeks, the market becomes more fearful as this drawdown extends, one can either join in the fear or attempt to profit from it. The choice is yours.

Chart of the Day: Sector Strength! The winners and losers of the pandemic…

Comments