Sideways < Bear Markets

- The Coachmen

- Jun 6, 2022

- 3 min read

Risk off, risk on! Markets were marginally up to start the week yesterday and that’s a good start in staying out of bear market territory which we’re only 5% away from at current S&P 500 levels. Read on for a standard Coachman’s Report today following our special on the housing market yesterday!

Hope is the pillar that holds up the world. Hope is the dream of a waking man.

- Gaius Plinius Secundus

Market Talk

Resource concerns seem to be one of the largest driver’s in the market’s recent price action, as depicted by its push to relatively calmer waters following the OPEC+ announcement of an increased supply of oil to the market last Thursday. In fact, the market advanced almost 2% on this news as energy cost inflation driven by the rally in both crude oil and nat gas has contributed to rising cost guidance in many reliant industries. That said, the VIX has managed to remain in and around the 25 level which is relatively calm given the conflict in Ukraine and the many possible risk-off catalysts facing the market today.

Last, alongside Boris Johnson’s win within the UK’s no-confidence vote, the UK 100 index rose sharply by 1% - outlining a renewed positive sentiment in his conservative government’s agenda. However, it’s worth noting that he only passed with a slim 58% majority (by comparison, former PM Theresa May had 63% of party support).

Long: Vail Resorts, Inc (MTN:NYSE) | Timeline: 1-2 weeks

Vail Resorts, Inc. (MTN), through its subsidiaries, operates mountain resorts and urban ski areas in the United States and Canada. Although the company has struggled through 2022, the hospitality industry is set for a comeback as Covid-19 restrictions continue to ease up, giving investors confidence in MTN leading up to their earnings report later this week. Taking a look at the chart, MTN traders have priced a triple bottom - a visual pattern that shows bulls beginning to take control back from the bears, with each bottom giving bulls more strength to catapult upwards through earnings season. This is a strong reversal pattern that many traders play, but putting a stop loss inside the pattern and trailing it up as the breakout occurs is ideal in order to minimize risk, and ramp up profit potential - per the Coachman Standard.

Short: Nvidia Corp (NVDA:NASDAQ) | Timeline: 2-5 days

Nvidia Corp. (NVDA), is the processor manufacturing powerhouse that needs little introduction. While this company has strong long-term prospects as the world becomes more digital, their outlook this week is not looking bullish, and as a result, we are recommending a short. First and foremost, the company is trading below its long-term moving averages after experiencing a death cross on April 19th.

Moreover, as displayed, the company has been consistently driven below support levels after brief periods of bullish momentum. Their next support level on the downside is just above $144, meaning bearish traders have a chance to earn roughly 23% in profits. Technicals aside, another strong indicator of bearish trends being on the horizon is when insiders sell large volumes of shares. Unfortunately for short-term Nvidia bulls, this is exactly what occurred on May 27th when board member and venture capitalist Mark Stevens unloaded $51M worth of shares, representing close to 10% of his total stake. Oftentimes when technicals and insider sales align, bears thrive while bulls try to survive, pick your side of the trade accordingly.

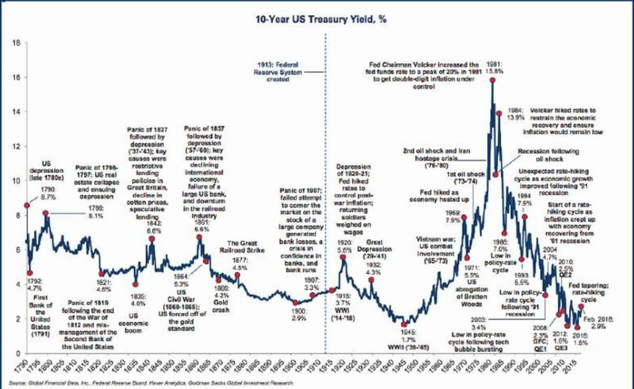

Chart of the Day - History of the 10-Year Treasury Yield

Comments