Risk on, Risk off.

- The Coachmen

- Jun 28, 2022

- 4 min read

Good morning Coachmen! After a lacklustre start to the markets this week, unless you’ve been following our trade ideas, we’re back and ready to roll into Wednesday’s trading session. Keep reading below for our usual picks and some possible inspiration from the Bullwhip effect’s impact on the economy; additionally, check out our first article published to CEO.ca on the current rationale behind shorting Japanese government bonds (JGBs).

“Nothing is more difficult, and therefore more precious, than to be able to decide.”

- Napoleon Bonaparte

Market Talk & Trade #1: Long Volatility ($VIX) | Timeline: 5-7 Days

Markets regressed yesterday with the S&P 500 falling 2.01%, the NASDAQ dropping by 2.98%, and the Dow Jones while volatility jumped at the declines with the $VIX closing up at $28.39 (6.57%). This comes as consumer sentiment deteriorates dramatically in countries across the globe, with many fearing, or expecting a recession within the year. This steep decline in confidence is best exemplified in Germany, as the GfK consumer climate index plummeted to a new recorded low of -27.4 points. Although in a potential relief for consumers, at the detriment of retailer profit mind you, there are rumblings that we are seeing the second stage of the Bullwhip effect in full swing, with powerhouses such as Target cutting both prices, and orders from manufacturers (Source).

After Monday’s and Tuesday’s trading sessions, the market is now far away from the S&P 500's 4000 point level, which gives way to a possible freefall as our next broad support level isn’t until the 3500 point level. This is another 9% drop from current price levels and there are multiple risk-off catalysts facing equities that can spike volatility and extend this sell-off. The first of which is a few key economic updates such as GDP, inflation and employment reports, which are all around the corner and have more eyes watching than ever as the recession question has become on the forefront of investors' minds. Additionally, with the Federal Reserve changing its interest rate agenda every other day, markets will get a true feel for their effects during the Q2 reporting period which is right around the corner and with investor sentiment almost 60% bearish, it is not looking good on the earnings surprise front. Last, Pope Francis has become wheelchair-bound, has cancelled multiple public events and has begun speaking about the possibility of a retirement; as much as you might think it wouldn’t, this could spark a material sell-off for markets as the worst month for equities within 2013 was that of his predecessor’s retirement announcement and subsequent retirement.

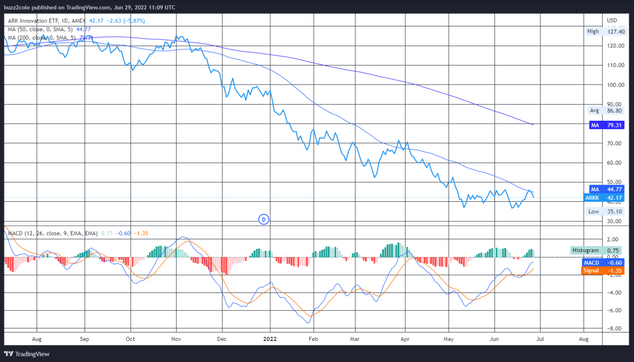

Short: Ark Innovation ETF ($ARKK-NYSE) | Timeline: 1-2 days

After shining as it had never shone before the tech sector is still taking a beating as we near the seventh month of the general market drawdown. Ark’s holdings, while once considered diversified, have all declined drastically since being added to Cathy's portfolio. Her top 8 equities by weight are all down over 5%, and as the NASDAQ looks prepped for another decline heading into Wednesday’s trading session, it’s unlikely that Ark will be able to climb in the coming days. The technicals also support this trade, as after experiencing a death cross in September of 2021, the 50-day has yet to cross back over the 200, signalling weakness. As recently as June 24, the stock attempted to break out of the current trendline by testing the 50-day moving average, however it was rejected and the stock moved lower as a result.

The Bullwhip Effect

The Bullwhip effect is a particularly dangerous pattern that occurs in a stagflationary cycle which has traditionally started by harming retailers of physical goods, before wreaking havoc elsewhere in the economy. The effect begins during an inflationary cycle or spike in consumer demand, most recently this was seen during the pandemic after the majority of Canada and the United States received stimulus cheques of varying sizes. After a buying spree began after the injection of cash across the board, demand spiked. Coincidentally, this demand spike occurred amid ongoing supply chain issues and later led to inventory shortages in many retailers. As a result, many ordered large quantities of goods in anticipation of another larger than normal sales cycle. However, as we now know it doesn’t look like many will have the disposable incomes that they once did in the coming months. So what does that mean for retailers? Well, it is likely that most retailers will now be forced to lower prices in order to free up space in distribution centres, while also cutting orders from wholesalers. This order cut will make its way through the value chain, eventually reaching distributors and suppliers. What are the takeaways from this? Personally, we believe that long-term investment in the retail sector should be made cautiously over the next 3-6 months as this effect plays out. In this situation it will be difficult for retailers to maintain high levels of profitability due to the reduction in the price of their goods, however, they may see increased sales as a result. Further

more, investments in suppliers and manufacturers should also be made cautiously, as they are likely set for extreme amounts of volatility.

Chart of the Day

Cotton: Abnormal trading pattern or the first commodity to fall?

The Coachman's Report - Terms and Conditions

Comments