Rate Hikes Keep it 💯

- The Coachmen

- Jul 13, 2022

- 2 min read

Well folks, yesterday was another doozy for financial markets with inflation coming in higher than expected at 1.3% and the Bank of Canada surprising everyone with a 100bp rate hike, bringing the overnight rate to 2.5%. Read on for your daily dose of trade ideas, centred today on the financial sector.

“You only have to do a few things right in your life so long as you don’t do too many things wrong.”

– Warren Buffett

Market Talk

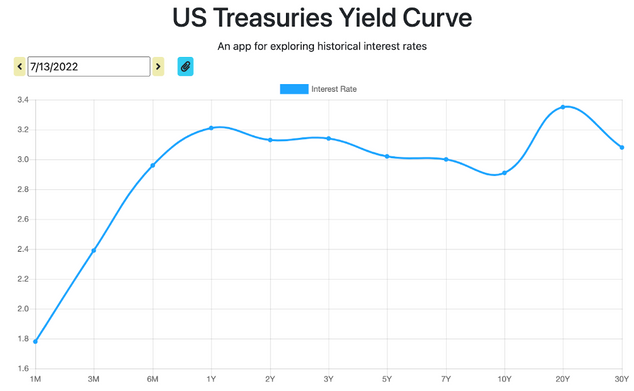

As the CPI print surprised markets yesterday it caused a major tightening of the yield curve, now giving 1-Year maturities a 3.21% yield and the overall curve an irregular profile.

Panning to Canada, the surprise 100bp rate hike did not have the TSX trading down to a high degree, it simply recessed a bit from the gains it made earlier in the session and still finished the day 50bps up and within its current price channel.

Short: Wells Fargo ($WFC-NYSE) Timeline: 3 days

For one of today’s trade ideas, we’re going to go short on Wells Fargo, due to poor revenue predictions, alongside their poor equity performance on a YTD basis. While the stock has maintained a stronger alpha compared to the NASDAQ by roughly 5.95%, it has underperformed the S&P 500 by roughly 2% on a YTD basis. While not a terrible measure by any means, banks are entering a period of reduced customer activity due to higher interest rates and inflation throughout the economy. Analysts are pricing in an EPS of $0.86, representing an increase from the previous quarter’s estimate by just over 6%. However, the question remains, why do analysts believe financial activity increased during the 2nd quarter? When consumers were spending 50-100% more than they used on gas, alongside a single-digit increase across other basic essentials. Especially as home prices, and renters delinquencies increase, it is quite unlikely that the bank will post strong results during today’s earnings release. Moreover, the technicals are signalling an impending selloff, as it has been trading below the 50 and 200-day SMA’s after experiencing a death cross on April 29th of this year.

Short: Citigroup Inc. (C-NYSE) | Timeline: 3-5 days

Citigroup Inc., a diversified financial services company that provides various financial products and services to consumers, corporations, governments, and institutions is set to report earnings tomorrow morning, and it’s not looking too great. The market has had a rough week after the red-hot inflation data has sent all indices spiralling while a tightening monetary policy has increased jobless claims to their highest since January. Taking a look at the chart, technicals on this stock further this bearish claim, as shorts have established a true and tried downtrend over the last couple of months. The MACD has stayed below 0 for the most part and has rejected entering the upper level as price action has broken below the lower level of a descending triangle - a widely used continuation pattern that signals downside momentum is likely to continue or become even stronger as the price breaks the lower level of the pattern.

Chart of the Day - Rate Reaction

Comments