Parity

- The Coachmen

- Jul 11, 2022

- 2 min read

Well folks, Tuesday is now upon us and the world looks a little bit different than it did yesterday as the Euro has fallen to a 20-year low and is now trading at parity with the greenback. If you caught our Rogers short yesterday you'd be up 4% by now, keep holding and stay true to our timeline, we believe there is further upside to be extracted from this trade. Read on for your daily dose of market inspiration in this shifting economic environment with two long picks on $TSMC and $MYNZ.

“Men in general are quick to believe that which they wish to be true”

— Julius Caesar

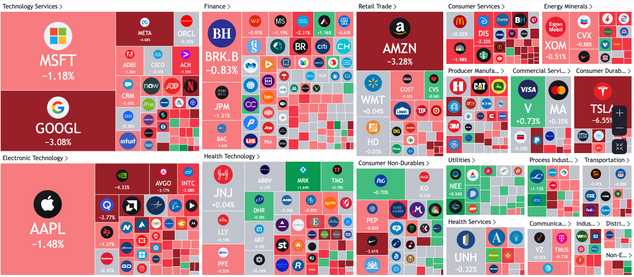

Market Talk

It was quite the start to the week yesterday with the S&P 500 trading down 40bps by close despite the USD closing the gap on the Euro - many of these losses were led by the tech sector with FAANG stocks markedly down the most out of all the large caps. A material risk-off catalyst hit the market though with Sri Lanka's capital being stormed by its people as they finally reject the ruling family's 13-year reign and are reportedly looking to install their own president to get the country back on track. Read more on the developing story here.

Long: Taiwan Semiconductor ($TSM-NYSE) | Timeline: 3 days

TSM is a premiere microchip manufacturing powerhouse which has suffered a recent downturn, falling over 35% YTD, and close to 44% from all-time highs. That being said, the company is in a unique position to pop this week, as they’re one of the few companies whose sales are predicted to be strong even in this global economic downturn. The company’s earnings, set to be released on the 14th, are predicted to be strong, as demand has been fierce after months of semiconductor scarcity throughout the pandemic. While the technicals do not support this trade, we are looking for a strong earnings report to catalyze growth within this trade.

Long: Mainz Biomed BV ($MYNZ-NASDAQ) | Timeline: 2-3 days

Mainz Biomed BV (MYNZ), a molecular genetics cancer diagnostic company, engages in developing market-ready molecular genetic diagnostic solutions for life-threatening conditions around the world. Ahead of their earnings report released later today, MYNZ recently announced they’re now working with Dante Labs to test their ColoAlert technology, and have now enrolled their first patient in the study. This is massive news to investors and news-driven traders, as these announcements bring MYNZ one step closer to an FDA approval and more volume pumped through the stock. Taking a look at the chart, MYNZ bulls have been waiting to capitalize on good news rolling into earnings, and it looks like traders have been catching wind of the fact as the MACD has crossed bullish, and the price has broken its falling wedge - a widely used pattern made of shaped trend lines and is considered a valuable indicator of a potential reversal in price action.

Chart of the Day - China’s GDP Growth Is Stalling!

Comments