FOMC Week!

- The Coachmen

- Sep 19, 2022

- 3 min read

Well folks we hope the weekend went well and that if you traded any of our picks last week it was $BOWL - the US’ leading bowling franchise which is up 7.5% since our recommendation. Also, it was the Queen’s funeral this morning which means that many UK markets are closed for trading today, most notably the LSE and LMX. Remember, the FOMC meeting tomorrow and Wednesday is likely to add some volatility to North American equities, so keep your finger on the pulse and trade with a stop loss!

“A multitude of words is no proof of a prudent mind.”

― Thales

Market Talk and Trade Recommendation | VIX - Timeline: 3 days

After indexes lost 5% across the board last week, they are shaping up for more red today as the $Dow, $S&P and $NDAQ are down 88, 89 and 93 bps respectively in the premarket. Further contributing to a lack of catalysts in the market is the fact that over 60% of firms within the S&P 500 have now revised their earnings guidance negatively for the Q3 period - should the Fed hike more than 1% in order to finally get it out of the way, it’s likely that more revisions will follow. Either way, betting on equities to advance on a lesser-than-expected hike from the Fed or on positive earnings has had a lower and lower likelihood as the days have gone by. Given all the risk-off sentiment in the market as well as the possibility of a 1.25% rate hike on Wednesday, there’s a high probability that the $VIX will clock in above 30 at some point this week, possibly hitting as high as 32-33. Lastly, it’s a light week on earnings with the most anticipated firms being Accenture, Costco and FedEx on Thursday.

Long: AutoZone, Inc. (AZO-NYSE) | Timeline: 2 days

AutoZone, Inc. (AZO), which retails and distributes automotive replacement parts and accessories has reported a promising 4th quarter earnings report to end its fiscal year 2021, despite inflation headwinds and rising freight costs. The company was able to beat earnings and revenue expectations by 5.0% and 3.6%, respectively, as “the investments we have made in both inventory availability and technology are enhancing our competitive positioning. We are optimistic about our growth prospects heading into our new fiscal year,” said Bill Rhodes, CEO (Source). Turning to the chart, AZO is up about 15% from the beginning of 2022, as bulls have been able to hold the stock above its 100-day MA, except for a few fakeouts pre-earnings. That being said, after the most recent retracement, bulls have continued to buy above that moving average while forming a double-bottom - a widely used bullish reversal pattern that indicates the last push lower toward a support level, followed by a breakout into a bullish rally.

Long: Shuttle Pharmaceutical Holdings (SHPH-NASDAQ) | Timeline: 2 days

Shuttle Pharmaceutical is an American biotech company currently creating an assortment of drugs to treat various cancers. Their most promising product, Ropidoxuridine, is a drug that assists with Sarcoma and is currently undergoing phase 1 human clinical trials. The company began trading on August 31, and afterwards, the stock jumped to as high as $126.26 before crashing down in the days that followed. Throughout last week’s trading, the company fell from $38.50 on Monday to $8.99 on Friday. While many could view this as a death sentence for profits, there is one factor that could lead to the company soaring over the next two days, the short interest.

As shown on the chart above, the company’s short interest has ballooned in recent days, even surpassing the early September highs. Currently, over 5M shares are being shorted, even though Shuttle’s float only amounts to 3.48M, with 13.28M shares outstanding. This means that the short interest % of the float is equal to 146%. This absurd ratio has also been noticed by other traders, and with the company up roughly 7% in the premarket at the time of writing it seems like a squeeze may be attempted today.

With that being said, as this is a risk on trade with more than a few variables in play, we’d institute a stop loss at 6%.

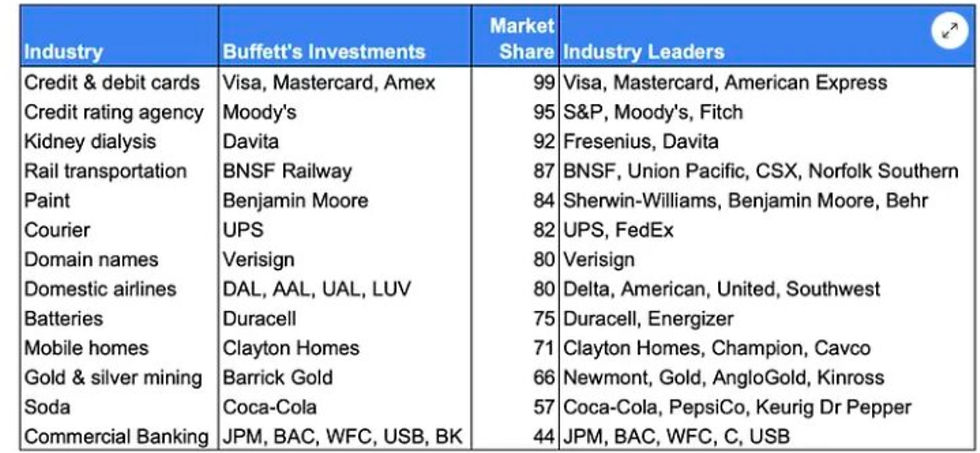

Chart of the Day: Buffett's Monopoly

Warren Buffet’s portfolio of monopoly and oligopoly firms...

Comments