Down goes the Pound!

- The Coachmen

- Sep 25, 2022

- 6 min read

Well folks, this weekend’s headlines spurred quite the buzz as the British Pound plunged further against other hard currencies, leading many to believe that the world’s oldest currency might implode once and for all. Additionally, rumours of a military coup in China that saw President Xi Jinping under house arrest were dispelled as misinformation - this all occurred in the face of their next ‘election’. Anyways, this is all likely to spike volatility and put markets in a tailspin so read on for your daily dose of market inspiration and remember to trade with a stop loss.

Markets in Review

The market is trading down this morning with Dow, S&P and Nasdaq futures 64, 74, and 64bps in the red. Today marks the start of the countdown until next Friday's jobs report on Oct 7th which, alongside this Q3 earnings period, will be key in helping the S&P 500 maintain its trend instead of losing ground. That said, the consensus amongst economists is that 355k non-farm payrolls will be added, deviation from this will affect the Fed’s interest rate agenda, so all eyes will be on that figure at 8:30 AM. Last, below are some of the most anticipated earnings for the week as well as some updated data on how this reporting period is shaping up: Earnings Growth: For Q3 2022, the estimated earnings growth rate for the S&P 500 is 3.2%. If 3.2% is the actual growth rate for the quarter, it will mark the lowest earnings growth rate reported by the index since Q3 2020 (-5.7%). Earnings Revisions: On June 30, the estimated earnings growth rate for Q3 2022 was 9.8%. Ten sectors are expected to report lower earnings today (compared to June 30) due to downward revisions to EPS estimates. Earnings Guidance: For Q3 2022, 64 S&P 500 companies have issued negative EPS guidance and 41 S&P 500 companies have issued positive EPS guidance. Valuation: The forward 12-month P/E ratio for the S&P 500 is 15.8. This P/E ratio is below the 5-year average (18.6) and below the 10-year average (17.0). Earnings Scorecard: For Q3 2022 (with 10 S&P 500 companies reporting actual results), 6 S&P 500 companies have reported a positive EPS surprise and 7 S&P 500 companies have reported a positive revenue surprise.

Trade of the Day - Short: Manchester United plc (MANU-NYSE) | Timeline: 2 days

Manchester United plc (MANU), which owns and operates a professional sports team in the United Kingdom reported earnings last Thursday, and things aren’t looking too great for investors. The company missed earnings and revenue estimates by 12.55% and 10.77%, respectively, and as the nation's currency continues to collapse the stock is prone to quite unfavourable volatility over the next couple of days. Turning to the chart, the stock is down 8.22% YTD as buyers have struggled to regain support above the 200-day MA. That said, an optimistic earnings report and macroeconomic stability could’ve resulted in a reversal, however, this was not the case and all momentum has shifted back to the bears signalled by the price re-crossing the 200-day MA and the MACD pointing downwards in a very overbought position.

Zooming out...

Iran on Fire

Protesters outside of the Vancouver Art Gallery on Sunday (Source)

Protests and demonstrations were staged in cities across the world in support of recent movements within Iran after the killing of 22-year-old Mahsa Amini. Amini died in Morality Police custody after not wearing her hijab properly. Many of these protests also spoke out against the ruling regime, with some calling for the end of Islamic theocracy within the nation. In Iran itself, a new wave of anger has been released against state forces as they shot and killed a female protester. Hadis Najafi, aged 20, was allegedly shot six times by security forces as she participated in the protests. Allegedly, over 100 other protestors have been killed, with another 1800 detained in Tehran as protests rage across 31 provinces within the nation. Never one to let a good crisis go to waste, the Iranian Guard has seized the opportunity to strike Kurd targets within Iraq.

Europe’s Shift to the Right

The victor of the most recent Italian election has been announced as none other than the coalition of Giorgia Meloni. Meloni has been described by many in the press as the most right-wing leader that Italy has seen in decades. The populist wave currently sweeping the continent is best displayed through this election when comparing it to votes cast in 2018. In 2018, Meloni’s party, the Brotherhood of Italy party, was only able to capture 4% of the vote. However, on Sunday exit polls showed that they were able to win between 22.5%, and 26.5% of the vote. Barring any surprises from the votes of junior coalition partners, Meloni is also set to be the first female Italian PM. What’s also important to note about Meloni’s platform, is that she is staunchly opposed to the EU overriding the sovereignty of individual member states. Italy is the second country to vote more to the right than normal after Sweden’s shock election results just a couple of weeks ago. The Euro opened this morning at a fresh 20-year low. Chinese Coup?

Reports erupted on social media over the weekend about a potential coup in China, in which Xi Jingping was removed from PLA command, and placed under house arrest. From what we’ve found, these reports mainly seem to stem from Indian gossip media, and up until this point, there has been no corroboration from any major media outlets. As such, until new evidence comes to light, we believe that these claims are false. Delayed Responses for Your Safety

Port Aux Basques, Newfoundland after Fiona (Source)

As hurricane Fiona ravaged the Eastern provinces over the weekend many were left helpless. Streets flooded, power was knocked out for hundreds of thousands, and some homes were even swept out to sea. At a time when every minute of a rescue effort counts, one would think that those who offered assistance would immediately be shepherded to the area. However, that wasn’t the case over the weekend as the ArriveCAN app delayed aid coming from the United States by hours. This delay has reignited a larger debate across Canadian society on the heavy-handed restrictions brought on by the government throughout the pandemic. While the Canadian government does have plans to scrap the program in the coming weeks, ending mandatory use of the app on October 1st, many have asked why it was used for so long, even as other nations, most notably the United States, have declared the pandemic over (Biden’s statement here). This debate is mainly being brought to the public light by the new opposition leader Pierre Pollievre, who seeks to take on incumbent Justin Trudeau in the next general election.

Taking a Pounding

Early into Monday morning, the Pound continued its dramatic slump against the USD as further fallout emerges from their recently unveiled fiscal plan. This plan, which we covered on Friday (linked here) promotes further borrowing from the Bank of England even as the nation is experiencing a period of high inflation much like the majority of the world. This most recent drop has led the Pound to its lowest value relative to the USD on record. UK gilt rates have also soared in response during the early morning hours.

Making headlines...

Oil stocks to rise on slower demand, OPEC cuts needed to bolster prices

Global oil stocks are set to rise next year amid weakening demand and a stronger U.S. dollar, executives at an oil conference said on Monday, adding that OPEC will have to cut output to reduce supply if they want prices to remain supported. (Full Story)

Piling Pressure on BOE

The sell-off in UK assets went into overdrive on Monday, sending the pound to an all-time low, slamming government bonds and sparking talk of emergency action by the Bank of England. (Full Story)

Ukraine war push global grain stocks toward a worrying decade low

The world is heading toward the tightest grain inventories in years despite the resumption of exports from Ukraine, as the shipments are too few and harvests from other major crop producers are smaller than initially expected, according to grain supply and crop forecast data. (Full Story)

Drone attack hits Ukraine

An overnight drone strike near the Ukrainian port of Odesa sparked a massive fire and explosion, the military said Monday, as Russia's leadership faced growing resistance to its efforts to call up hundreds of thousands of men to fight in Ukraine. (Full Story)

Scotiabank names Scott Thomson as CEO

Bank of Nova Scotia said on Monday that Scott Thomson would take over as chief executive officer of the Canadian bank from Feb. 1, replacing Brian Porter who will retire at the end of January. (Full Story)

Lebanon retirees scuffle with police

Lebanese army retirees scuffled with police as they briefly broke through a cordon leading to Parliament in downtown Beirut during a rally Monday over their decimated monthly pay amid the country's economic meltdown. (Full Story)

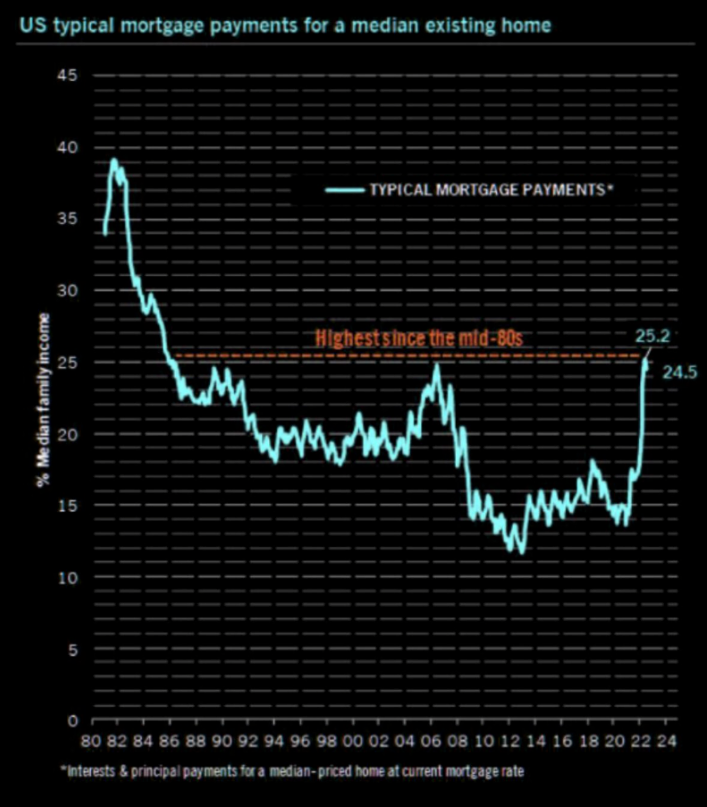

Chart of the Day - Mortgages Still Aren’t Cheap

“Aquila non capit muscas" | "The eagle does not catch flies”

- Early Roman Empire

Comments